Seattle King County Sales Tax Rate: The Ultimate Guide For Smart Shoppers

So here we are, diving into the world of Seattle King County sales tax rate because let's face it—taxes can be as confusing as trying to navigate rush hour in downtown Seattle without GPS. If you've ever stood at the checkout counter wondering why your total bill seems to have a mind of its own, you're not alone. Today, we're breaking it down for you—what the sales tax rate is, how it works, and why it matters to your wallet. This ain't just numbers; this is real-life stuff that affects every single purchase you make in King County.

Before we jump into the nitty-gritty, let's get one thing straight—sales tax isn't some random fee the government invented to make life harder. It's a crucial part of how local governments fund essential services like schools, roads, and public safety. In King County, the sales tax rate is a bit more complex than in other parts of the country, so buckle up because we're about to decode it for you. And trust us, by the end of this article, you'll be a sales tax pro.

Now, if you're thinking, "Do I really need to know all this?" the answer is a big fat yes. Whether you're a local resident, a business owner, or just visiting Seattle for the weekend, understanding the sales tax rate can save you money and headaches. So, grab a coffee, sit back, and let's unravel the mystery of Seattle King County sales tax rate together. Let's do this!

Read also:Wendy Williams Leaked The Inside Scoop You Need To Know

Understanding the Basics of Seattle King County Sales Tax Rate

Alright, let's start with the basics. The Seattle King County sales tax rate is not a one-size-fits-all kind of deal. It's a combination of different tax layers that add up to give you the final rate you see at the register. Think of it like a layered cake—each layer has its own flavor, and together they create something pretty tasty (or in this case, pretty confusing).

The base rate in Washington State is set by the state government, but counties and cities can add their own taxes on top of that. In King County, the total sales tax rate currently hovers around 10.1%, but it can vary depending on where exactly you're shopping. For example, if you're buying something in Seattle, the rate might be slightly different than if you were shopping in Bellevue or Renton. Confusing, right? But don't worry, we'll break it down further in the next sections.

Why Does Seattle King County Have a Higher Sales Tax Rate?

Now, you might be wondering, "Why does Seattle King County have such a high sales tax rate compared to other places?" Well, the answer lies in the services and infrastructure that the tax supports. King County is one of the most populous counties in Washington State, and it needs funds to maintain all the awesome stuff that makes living there worthwhile. From public transportation to emergency services, the sales tax helps keep the wheels turning.

Plus, Seattle is a major metropolitan area with a booming economy, which means there's a higher demand for services. The extra tax revenue helps fund projects like expanding light rail lines, improving parks, and even supporting affordable housing initiatives. So, while it might seem like a lot, the sales tax is actually working behind the scenes to make life in King County better for everyone.

How Is the Seattle King County Sales Tax Rate Calculated?

Calculating the Seattle King County sales tax rate might sound like rocket science, but it's actually pretty straightforward once you get the hang of it. The total sales tax rate is made up of several components, including the state sales tax, county sales tax, and any additional local taxes. Here's a quick breakdown:

- State Sales Tax: Set by the Washington State government, currently at 6.5%.

- County Sales Tax: Added by King County, usually around 1.5%.

- Local Sales Tax: Varies depending on the city or district, ranging from 2% to 3%.

So, if you're buying something in Seattle, your total sales tax rate would be the sum of all these components. For instance, if the local tax in Seattle is 2.1%, the total sales tax rate would be 6.5% + 1.5% + 2.1% = 10.1%. Easy peasy, right?

Read also:Berks County Deaths Reading Eagle Newspaper Reports Unveiled

Breaking Down the Tax Layers

Let's dive a little deeper into those tax layers. The state sales tax is a flat rate across Washington State, but the county and local taxes can vary. Some cities in King County have additional taxes for specific purposes, like funding transit or cultural programs. These extra taxes are often approved by voters in local elections, so they reflect the priorities of the community.

For example, the Metropolitan King County Council might approve a temporary sales tax increase to fund a new transit project. Once the project is completed, the tax rate could go back down. This flexibility allows King County to adapt to changing needs and priorities, but it also means the sales tax rate can fluctuate over time.

Who Pays the Seattle King County Sales Tax Rate?

Here's the million-dollar question—does everyone have to pay the Seattle King County sales tax rate? The short answer is yes, pretty much everyone who makes a purchase in King County is subject to the sales tax. Whether you're buying groceries, clothes, or electronics, the sales tax applies to most retail transactions. However, there are a few exceptions.

For instance, certain essential items like unprepared food and prescription medications are exempt from sales tax. Nonprofit organizations and government agencies may also qualify for tax exemptions under specific circumstances. If you're a business owner, it's important to understand these exemptions because they can affect how you calculate and collect sales tax from your customers.

Exemptions and Special Cases

Let's talk about those exemptions for a moment. The Washington State Department of Revenue provides detailed guidelines on which items are exempt from sales tax. For example, raw fruits and vegetables are exempt, but prepared meals or snacks are not. This can get tricky for businesses that sell both taxable and non-taxable items, so it's crucial to stay informed about the rules.

Special cases like sales tax holidays or temporary exemptions can also come into play. During these periods, certain items might be exempt from sales tax to encourage consumer spending or support specific industries. Keep an eye out for these opportunities if you're looking to save a few bucks on your next big purchase.

How Does Seattle King County Sales Tax Rate Compare Nationally?

When it comes to sales tax rates, Seattle King County is on the higher end compared to other parts of the country. While some states have no sales tax at all, others have much lower rates. For example, the sales tax rate in neighboring Oregon is 0%, which makes shopping there pretty appealing for Washington residents. However, King County's rate is still lower than some major cities like New York City, where the combined sales tax rate is around 8.875%.

It's important to note that sales tax rates can vary widely even within the same state. For instance, the sales tax rate in Spokane, another major city in Washington State, is slightly lower than in King County. This can create interesting scenarios where people travel to neighboring areas to take advantage of lower tax rates. But hey, who doesn't love a good bargain hunt?

Tips for Managing Seattle King County Sales Tax Rate

Now that you know the ins and outs of the Seattle King County sales tax rate, let's talk about how you can manage it effectively. Whether you're a consumer or a business owner, there are strategies you can use to minimize the impact of sales tax on your finances.

- Shop During Tax Holidays: Take advantage of special sales tax holidays when they're offered. These periods can save you a significant amount of money on eligible items.

- Stay Informed: Keep up with changes in sales tax laws and regulations. The Washington State Department of Revenue website is a great resource for staying updated.

- Use Tax-Exempt Items Wisely: If you're a business owner, make sure you're correctly identifying and handling tax-exempt items to avoid overcharging customers.

For businesses, implementing a robust sales tax management system can help ensure compliance and accuracy. Whether you're using software or working with a tax professional, having a solid system in place can save you time and money in the long run.

Tools and Resources for Businesses

If you're a business owner, there are plenty of tools and resources available to help you manage sales tax. The Washington State Department of Revenue offers online resources, webinars, and even a mobile app to help businesses stay compliant. Additionally, third-party software like Avalara and TaxJar can automate the sales tax calculation and filing process, saving you time and reducing errors.

Remember, staying on top of sales tax regulations isn't just about avoiding penalties—it's also about building trust with your customers. When people see that you're handling taxes correctly, it boosts their confidence in your business.

Future Trends in Seattle King County Sales Tax Rate

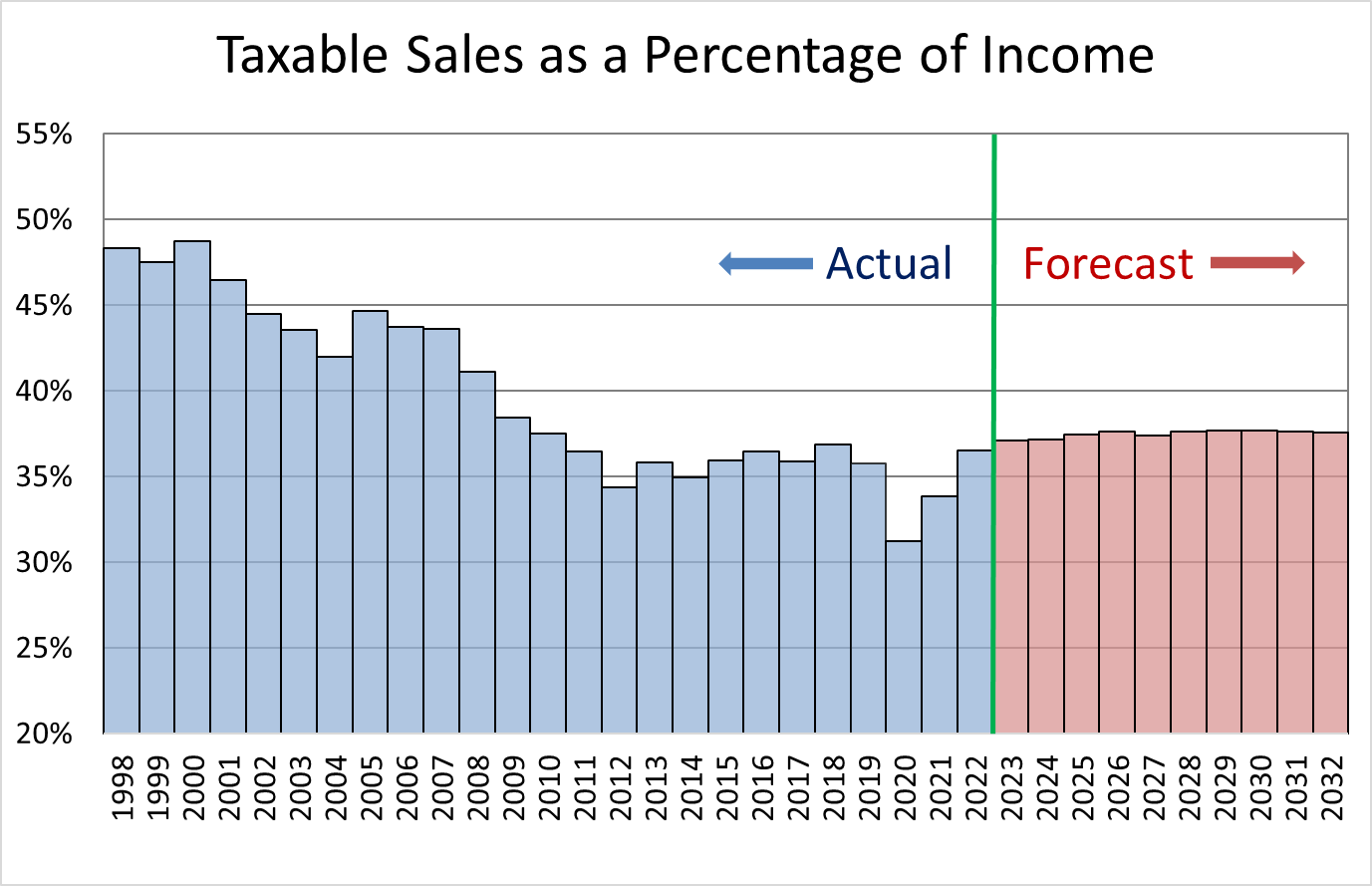

Looking ahead, what can we expect from the Seattle King County sales tax rate? As the region continues to grow and develop, it's likely that we'll see changes in how sales tax is applied and collected. For example, the rise of e-commerce has created new challenges for sales tax collection, and states are scrambling to adapt.

Washington State has already taken steps to address this by implementing a remote seller nexus law, which requires out-of-state sellers to collect and remit sales tax if they meet certain thresholds. This ensures that online retailers contribute their fair share to the local economy. As technology continues to evolve, we can expect more innovations in how sales tax is managed and collected.

Potential Changes on the Horizon

Another potential change is the introduction of new taxes to fund specific projects or initiatives. For example, as King County works to expand its public transportation network, there might be additional taxes levied to support these efforts. While this could mean higher sales tax rates in the short term, the long-term benefits could include reduced traffic congestion and improved air quality.

It's also worth noting that voter-approved measures can have a significant impact on sales tax rates. If you're a resident of King County, make sure to stay informed about local elections and ballot measures that could affect your wallet.

Conclusion: Taking Control of Your Sales Tax Knowledge

There you have it—everything you need to know about the Seattle King County sales tax rate. From understanding the basics to managing the impact on your finances, we've covered it all. Remember, knowledge is power, and knowing how sales tax works can help you make smarter financial decisions.

So, what's next? We encourage you to share this article with friends and family who might benefit from the information. And if you have any questions or thoughts, don't hesitate to leave a comment below. Let's keep the conversation going and help each other navigate the sometimes murky waters of sales tax.

Oh, and one last thing—don't forget to bookmark this page for future reference. You never know when you might need a quick refresher on Seattle King County sales tax rate. Thanks for reading, and happy shopping!

Table of Contents

- Understanding the Basics of Seattle King County Sales Tax Rate

- Why Does Seattle King County Have a Higher Sales Tax Rate?

- How Is the Seattle King County Sales Tax Rate Calculated?

- Who Pays the Seattle King County Sales Tax Rate?

- How Does Seattle King County Sales Tax Rate Compare Nationally?

- Tips for Managing Seattle King County Sales Tax Rate

- Future Trends in Seattle King County Sales Tax Rate

- Conclusion: Taking Control of Your Sales Tax Knowledge